Visie

Insurance companies and banks are finding that their solvency and earnings are under pressure. Cutting costs is at the top of management's agenda. You have to do more with less.

Meanwhile, reporting requirements are growing exponentially. More and more information has to be reported externally, in shorter and shorter deadlines. The board also wants to have reliable management information available rapidly.

Data is crucial, for analysis of and information about customers, products and returns. Finance and Risk systems are often not implemented in a way that adequately releases the treasure to be found in the data.

In practice, colleagues in Finance and Risk are still spending a large part of their time manually assembling, preparing and checking information. This often leaves insufficient time for analysis and decision support.

Bottlenecks in the current situation

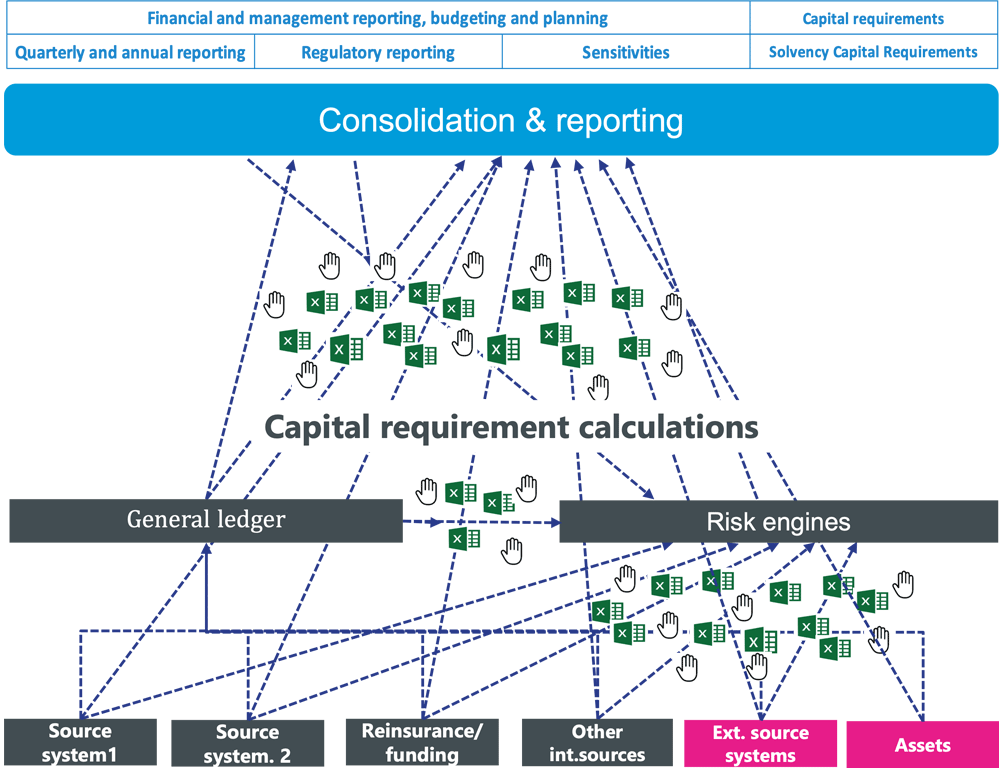

The reporting chain of the average insurance company or bank looks roughly like this.

The challenges in the current situation are created primarily by a "report-driven" approach, where the data is requested afresh for each reporting process. Very often, as in the above example, a large number of tools are being used, with data being assembled, checked and processed manually for each link of the chain.

This approach can create a number of pain points. Because the data is accessed and defined several times, discrepancies arise as the result of inconsistent data definitions. The use of interlinked, unstructured Excel sheets with manual calculations creates the risk of errors and dependency on individuals.

The data flow in a situation like this is extremely complex and difficult to track. It is a major challenge to maintain control of the whole process. There is no audit trail and minimal documentation. As a result, it is difficult to prove the data quality. Thanks to the many manual interventions needed, pressure of work, especially in the Actuarial department, is very high, and there is barely any time available for information requests or analysis.

Despite all these pain points, we have good news. You can actually do it a lot better.

Our vision

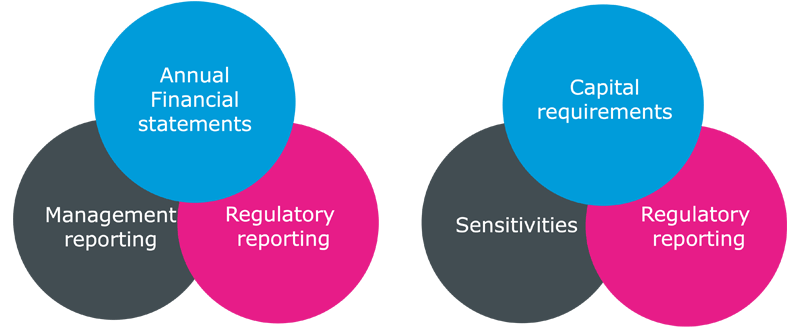

In the last few years, the reporting requirements on banks and insurance companies have increased hugely. An analysis of the different processes and reports reveals that each time it is the same data that is needed, simply at a higher or lower level of granularity.

Visualisation of the same data needed for the different processes.

The solution

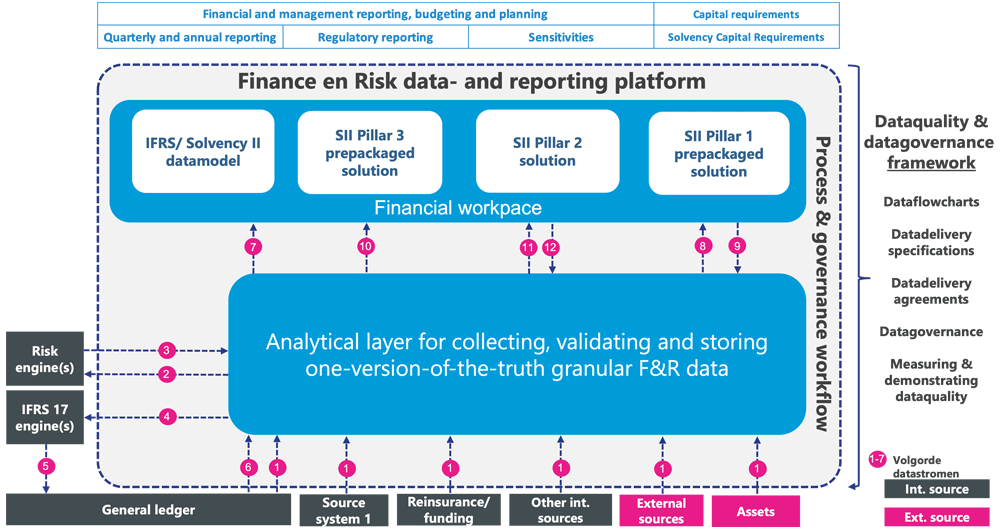

To comply with rules and regulations, remain competitive in tomorrow's world, and be in a position to act as business partners for Finance and Risk, we believe that insurance companies and banks need a robust, data-driven and integrated reporting chain, combined with a practical approach to handling the data quality management framework.

Visualisation of an integrated reporting chain for a medium-sized insurance company

A single source of truth

The core of an integrated chain consists of a central data source, where the detailed data is stored initially. With a central data store, you are not putting the spotlight on the reports, but on the data. With this approach you create a single version of the truth, and you only need to collect the data once. This makes variances caused by different data definitions a thing of the past. Starting from the central data store, the data is re-used for each target process further down the chain.

The data is validated when it is first uploaded into the central data store. Potential data quality issues are therefore caught early on in the reporting process..

The central data store includes detailed data, for reporting and also for actuarial and financial calculations and analyses. Finance and Risk will also be using the same, validated data source.

Read more about data-driven reporting.

Integrated reporting environment

From the central data store, the data is then automatically loaded into the integrated reporting environment, where the reporting data is validated, consolidated and processed. Using validation rules, data quality is enforced, guaranteeing consistency between reports, and making this traceable.

As soon as the figures are validated, the reporting data is locked down. Any corrections are stored separately to the original source data. This means there is always a path back to the source, and only the corrections, if there are any, need to be approved.

The maintenance of the required regulatory reports is outsourced to a software vendor, with the vendor taking care of their conversion to the required XBRL format.

Cut and paste work from a reporting database into Word or PowerPoint, and endless consistency checks after amending the figures are all relegated to the past, thanks to automatic links to the reporting database. Reports for the annual accounts, the RSR and SFCR and Basel reports are generated in Word or PowerPoint.

Read more about the integrated reporting environment.

Providing data quality and data governance from the ground up.

You cannot resolve all the bottlenecks just by using tools. Who, for example, actually owns your data and how do you ensure that all suppliers provide their data correctly, completely and in good time? How do you raise awareness in your organisation of the importance of data quality? How do you measure the quality of the data in the source systems and how do you render the data quality of the key data traceable in a practical way? Last but not least, how do you prevent the data quality being a one-off campaign, and instead root it deep in the structure of the organisation?

A practical framework is needed to manage data quality in order to safeguard the correctness, completeness and timeliness of the data along the entire chain. Data quality becomes embedded in the structure of the organisation through the use of a data quality cycle.

Read more about taking control of data quality.

Enterprise architecture

Realising the above vision starts by setting the target on the horizon: the design of the enterprise architecture. When designing the architecture you must take into account your internal developments, as well as the requirements arising from the IFRS, Basel and Solvency II regulations.

A well thought out enterprise architecture is essential if you are going to take well-informed decisions about the different components, such as general ledger, central data store, calculation engines and the reporting solution. The architecture is also the foundation for major changes such as IFRS 17.

As soon as you have set the target on the horizon, you can define the route you will take to achieve the vision. The point of departure will be different in each bank or insurance company.

Read more about an enterprise architecture.

What does this vision mean in practice?

- Finance, Risk and other stakeholders are using one and the same “single source of truth” data source. This means that things like differences in data definitions, data redundancy, having to collect data from all around the company are now things of the past.

- The data is validated at the beginning of the chain, meaning that problems in the data are uncovered at an early stage.

- The validated data source is not only used for the regulatory reporting, but also for financial and actuarial analyses.

- Reports are no longer hand-crafted, they are generated automatically.

- Many of the repetitive tasks in Finance and Risk (in practice this can be over 50%) are automated. This not only means working faster and with improved quality, but it reduces the costs of creating the reports.

- There is much better oversight and control of the whole reporting process.

- The audit trail and transparency is vastly improved thanks to the reduction in the number of tools and the simplification of the data streams.

- Automation makes the reporting process faster and guarantees the continuity of the reports.

- Thanks to the data quality cycle, the correctness, completeness and timeliness of the data underlying Solvency II, Basel and IFRS reporting, and the most important management information, are safeguarded and embedded in the organisation in a practical way.

- Changes to IFRS, Solvency II or Basel regulations in the standard templates and calculation rules, including generating the mandatory XBRL delivery format are covered by the software vendor.

- Finance and Risk are future-proofed against more and more detailed data being required in reports with shorter and shorter deadlines.

- Meanwhile the costs of the reporting process reduce, Finance and Risk have more time for financial and actuarial analysis, putting them in a position to create optimum value working as business partners.

Want to read more?

Read more about our vision in the various articles we have published about this.

Want to know more?

Interested to find out how our vision could contribute to the reporting chain in your organisation? Get in touch with us.